State-owned CPC Corp, Taiwan (CPC, 台灣中油) is considering investing in shale gas extraction and a petrochemical plant in the US, company chairman Derek Chen (陳金德) said yesterday.

Chen is scheduled to depart for the US on June 14 on a fact-finding visit.

Chen said that CPC and its affiliates would like to invest about US$10 billion in the US, with the aim of adopting more advanced technology to produce higher-quality ethylene at a lower cost.

He said the first step is next month’s visit to the US, when he will be accompanied by Minister Without Portfolio Ho Mei-yueh (何美玥), to explore the possibility of investing in natural gas in Louisiana.

One issue of concern is whether petrochemical products from a CPC downstream factory would have a strong market in the US, Chen said, noting that since US President Donald Trump took office in January, he has made US manufacturing a top priority.

If the project gets off the ground, Chen forecast a September start date.

However, he added that state-owned companies like CPC are subject to certain regulations that could slow overseas investment efforts and hamper quick adaptation to changing markets.

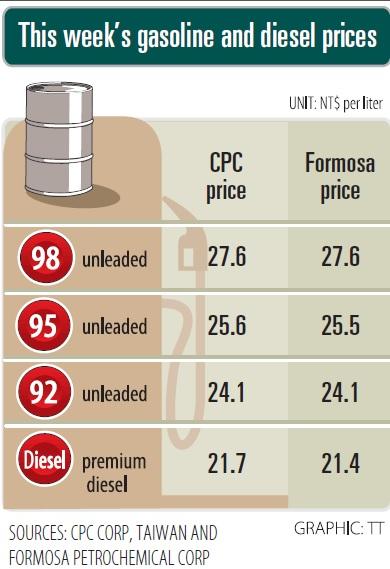

Separately, CPC yesterday said it is to raise its domestic gasoline and diesel prices by NT$0.2 per liter, starting today. It is to be the company’s second price hike in two weeks.

After the increase, prices at CPC gas stations nationwide are to be NT$21.7 per liter for super diesel, NT$24.1 per liter for 92-octane unleaded, NT$25.6 per liter for 95-octane unleaded and NT$27.6 per liter for 98-octane unleaded, the company said.

The prices reflect a rise last week in international crude oil prices after OPEC and non-OPEC producers on Thursday agreed to extend oil output cuts for another nine months until March next year.

A drop in US oil stocks for the seventh straight week also pushed crude prices higher, CPC said.

CPC calculates its weekly fuel prices based on a weighted oil price formula made up of 70 percent Dubai crude and 30 percent Brent crude.

After the increase in international crude prices, CPC’s average price of crude oil was calculated at US$52.44 per barrel this week, up from US$51.28 per barrel last week, it said.

Privately owned refiner Formosa Petrochemical Corp (台塑石化) on Saturday announced similar price increases for this week.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

It is challenging to build infrastructure in much of Europe. Constrained budgets and polarized politics tend to undermine long-term projects, forcing officials to react to emergencies rather than plan for the future. Not in Austria. Today, the country is to officially open its Koralmbahn tunnel, the 5.9 billion euro (US$6.9 billion) centerpiece of a groundbreaking new railway that will eventually run from Poland’s Baltic coast to the Adriatic Sea, transforming travel within Austria and positioning the Alpine nation at the forefront of logistics in Europe. “It is Austria’s biggest socio-economic experiment in over a century,” said Eric Kirschner, an economist at Graz-based Joanneum

BUBBLE? Only a handful of companies are seeing rapid revenue growth and higher valuations, and it is not enough to call the AI trend a transformation, an analyst said Artificial intelligence (AI) is entering a more challenging phase next year as companies move beyond experimentation and begin demanding clear financial returns from a technology that has delivered big gains to only a small group of early adopters, PricewaterhouseCoopers (PwC) Taiwan said yesterday. Most organizations have been able to justify AI investments through cost recovery or modest efficiency gains, but few have achieved meaningful revenue growth or long-term competitive advantage, the consultancy said in its 2026 AI Business Predictions report. This growing performance gap is forcing executives to reconsider how AI is deployed across their organizations, it said. “Many companies