Hon Hai Technology Group (鴻海科技集團) yesterday said the company is to collaborate with Alibaba Group Holding Ltd (阿里巴巴) to invest ¥14.5 billion (US$118.25 million) each in a robotics subsidiary of Japan’s Softbank Corp.

Hon Hai and Alibaba are to each hold ownership stakes of 20 percent in Softbank Robotics Holdings Corp, while Softbank is to control 60 percent of its subsidiary following the completion of the investment, Hon Hai said in a statement.

Under the terms of the agreement, the paid-in capital of Softbank Robotics would be ¥72.5 billion.

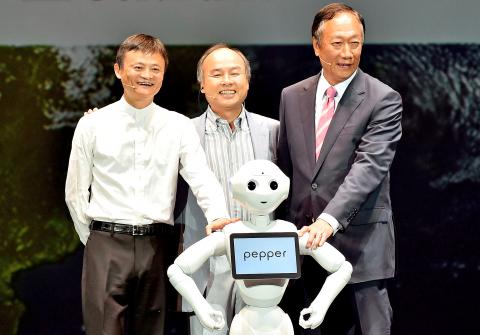

Photo: AFP

“Foxconn is pleased to be partnering with Softbank and Alibaba as part of our effort to drive the advancement of robotics engineering,” Hon Hai Precision Industry Co (鴻海精密) chairman Terry Gou (郭台銘) said in the statement.

Hon Hai said that the strategic alliance with Alibaba and Softbank would facilitate the sale of Softbank’s Pepper robot and other robotic products on the global market.

“With Softbank’s advanced software and Internet technologies, and Foxconn’s hardware component integration, Pepper has grown rapidly... in the past year,” Gou told a Web-broadcasted press conference in Japan.

Gou said that robotics development is a strategic area of focus for Foxconn as the company continues to invest its capabilities in intelligent manufacturing.

Softbank founder and chief executive officer Masayoshi Son said he is excited to partner with Alibaba and Foxconn to face the challenge of going global with the bank’s robotics business.

“We will aim to be the No. 1 robotics company,” Son said.

Alibaba founder and chairman Jack Ma (馬雲) said he foresees robotics becoming a critical field that catalyzes technological breakthroughs in many sectors, such as public services, healthcare, research and in the home.

He said the alliance would pave the way for robotics research and development, stressing that with cutting-edge technologies, he thinks robotics can positively impact millions of lives.

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Taiwan will prioritize the development of silicon photonics by taking advantage of its strength in the semiconductor industry to build another shield to protect the local economy, National Development Council (NDC) Minister Paul Liu (劉鏡清) said yesterday. Speaking at a meeting of the legislature’s Economics Committee, Liu said Taiwan already has the artificial intelligence (AI) industry as a shield, after the semiconductor industry, to safeguard the country, and is looking at new unique fields to build more economic shields. While Taiwan will further strengthen its existing shields, over the longer term, the country is determined to focus on such potential segments as

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors