The asset quality of Taiwan’s companies and households remains stable, meaning limited risk for the domestic financial sector even if the US Federal Reserve raises interest rates later this year, the central bank and analysts said in their latest reports.

Taiwan will be less prone to financial turmoil once the Fed ends its quantitative easing (QE), which may drive global funds to the US and upset financial stability in emerging economies, the central bank said in its Financial Stability Report, released on Friday.

The annual report, which covers economic and financial conditions for the whole of last year to the first four months of this year, identifies US interest-rate hikes, global economic slowdown and oil price rebounds as major risks that may rattle financial markets around the world moving forward.

“The more fragile the economy, the more vulnerable its foreign exchange and stock markets are to global fund movements,” the central bank said, adding that the rate hikes may affect economic activity as well.

Apart from the Fed, other central banks such as the European Central Bank and the Bank of Japan have implemented QE to boost their economies, but their practices have raised increasing criticism from emerging economies, with Reserve Bank of India Governor Raghuram Rajan recently warning that competitive monetary easing poses a serious risk to sustainable global growth.

In a speech in New York on May 19, Rajan questioned the prolonged use of unconventional monetary policies to boost growth on concerns that it may create risks in the financial industry once such policies come to an end.

However, Taiwan would withstand the volatility unharmed, thanks to its stable economic growth, solid current-account surplus and ample foreign exchange reserves, the central bank said in the report.

The Fed reached similar conclusions in a report last year that found Taiwan the least susceptible to its QE tapering.

JPMorgan Securities Ltd also said that Taiwan is relatively immune from capital outflow upon US interest rate normalization and reckons that asset quality is not an immediate risk for Taiwan’s financial sector.

However, the US brokerage said in a clients’ note on Monday that already-low credit costs have made it more difficult for the sector to grow earnings.

“While there remain muted catalysts for loan growth and net interest margin expansion to drive [the sector’s] pre-provision operating profit for 2015,” JPMorgan analysts Jemmy Huang (黃聖翔) and Josh Klaczek said in the note.

At the end of last year, the sector’s average capital adequacy ratio, core tier 1 capital ratio and common equity tier 1 ratio were 12.3 percent, 9.6 percent and 9.4 percent, respectively, all higher than 2013.

However, JPMorgan said the Taiwanese financial sector’s capital position remains weaker on a regional basis.

That explains why several banks have recently adopted various capital enhancement measures — including rights issues, additional tier-1 issues, private placement and share swaps — to fund growth and prepare for future mergers and acquisitions, the brokerage said.

Additional reporting by Kevin Chen

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

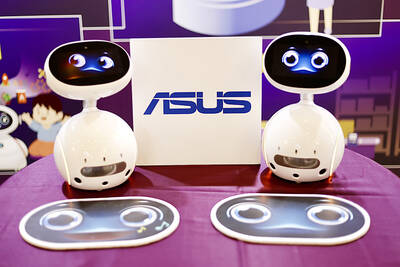

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would