Argentina cannot turn its back on negotiations with holdout creditors after defaulting on its sovereign debt, a US judge instructed on Friday, just as the country’s failure to service a June interest payment was declared a “credit event.”

US District Judge Thomas Griesa in New York slammed the decision by Latin America’s third-biggest economy to defy his order that it pay in full the holdout investors suing it instead of defaulting on its US$29 billion debt.

As Griesa was speaking, a 15-member committee facilitated by the International Swaps and Derivatives Association (ISDA) voted unanimously to call the missed coupon payment a “credit event.” The move triggers a payout process for holders of insurance on Argentine debt, which analysts estimate could amount to roughly US$1 billion.

“Nothing that has happened this week has removed the necessity of working out a settlement,” Griesa said. He chided Argentina for making public statements he characterized as misleading. “The debts weren’t extinguished. There’s no bankruptcy, no insolvency proceedings... The debts are still there.”

The veteran judge has been at the center of Argentina’s drawn-out fight against the New York hedge funds suing it for full payment on bonds they bought cheaply following the country’s record 2002 default on its US$100 billion debt.

Argentine bond prices slightly extended earlier losses after Griesa’s comments.

The Buenos Aires Stock Exchange Merval Index pared earlier losses to trade down just 0.6 percent from Thursday’s close at 8,150.91. The Argentine peso traded slightly weaker on the black market at 12.7 pesos per US dollar.

Griesa told both sides to continue working with mediator Daniel Pollack, a lawyer one senior Argentine government minister had dubbed “incompetent” a day earlier.

Argentina’s lead lawyer told the judge the Buenos Aires government had no confidence in Pollack after he released a statement after negotiations broke down saying the case had become “highly politicized.”

“The Republic of Argentina believes ... it was harmful and prejudiced to the republic and the impact on the market,” lawyer Jonathan Blackman said in an exchange that prompted Griesa to tell the hearing that everyone should “cool down” about ideas of mistrust.

The Argentine government says it has not defaulted because it made a required interest payment to a bank intermediary on one of its bonds. However, Griesa blocked that deposit in June, saying it violated his ruling that Argentina settle its dispute with holdout investors first.

As a result, holders of exchanged Argentine bonds did not receive the interest coupon payment by the July 30 deadline.

On Friday, the ISDA-facilitated Determinations Committee declared that a “failure to pay” event had happened. It will now hold an auction to settle outstanding credit default swap (CDS) transactions.

CDS reaction was muted as the market waited for ISDA’s auction process to start and investment accounts were hesitant to take positions.

“The amounts are not very large. We estimate the amount of CDS outstanding for Argentina at about US$1 billion; it’s not something that’s going to systemically affect financial markets,” said Jorge Mariscal, emerging markets chief investment officer at UBS Wealth Management.

Before Friday’s hearing, the Argentine government had said it expected nothing favorable to come from Griesa. It had previously called the federal judge an “agent” of the New York hedge funds.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

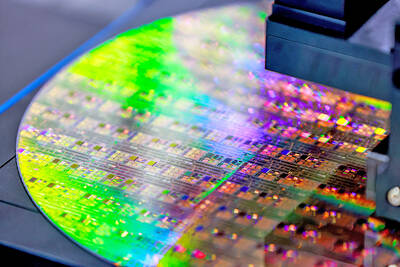

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September