Left out by telecom firms like the one owned by billionaire Carlos Slim, a remote Mexican mountain village now runs its own mobile phone network to communicate with the outside world.

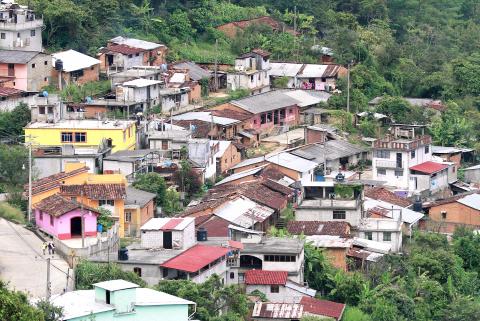

Tucked away in a lush forest in the southern state of Oaxaca, the indigenous village of Villa Talea de Castro, population 2,500, was not seen as a profitable market for companies such as Slim’s America Movil.

So the village, under an initiative launched by indigenous groups, civil organizations and universities, put up a perch-like antenna on a rooftop, installed radio and computer equipment, and created its own micro provider called Red Celular de Talea (RCT) this year.

Photo: AFP

Now, restaurant manager Ramiro Perez can call his children and receive food orders on his cellphone at a cheap price in this village dotted by small homes painted in pink and yellow.

The local service costs 15 pesos (US$1.2) per month — 13 times cheaper than a big firm’s basic plan in Mexico City — while calls to the US, where many of the indigenous Zapoteco residents have migrated, charge a few pennies per minute.

“I have two children who live outside the village and I communicate with them at least two or three times per week,” said Perez, 60.

Photo: AFP

Before, Perez had to use telephone booths where he paid up to 10 pesos per minute.

The coffee-producing village installed the network with the help of Rhizomatica, a non-profit with US, European and Mexican experts who aim to increase access to mobile telecommunications in communities that lack affordable service.

In a statement, Rhizomatica, a civil group named Redes and a town official said they hoped that a telecom reform pushed through congress by Mexican President Enrique Pena Nieto to open the market will “break the obstacles” that prevent the development of such community-based projects.

“Many indigenous communities have shown interest in participating in this project and we hope that many more can join this scheme,” the statement said.

The equipment used in Talea, which was provided by California-based Range Networks, includes a 900Mhz radio network and computer software that routes calls, registers numbers and handles billing. Calls to the US are channeled via a voice-over Internet protocol (VoIP) provider.

The village received a two-year-permit from the Federal Communications Commission to have the right to test the equipment.

When a cellphone user arrives in the village, a text message automatically appears saying: “Welcome to the Talea Cellular Network (RTC) — to register, go to the radio with this message.”

There is one catch: Phone calls must be limited to a maximum of five minutes to avoid a saturation of lines.

Israel Hernandez, a village resident and one of the volunteers who helped set up the system, said the network uses the radio-electric spectrum that “telephone [service] providers refuse to use because it is financially unviable.”

Slim’s Telcel is part of his America Movil empire, which controls 70 percent of Mexico’s mobile phone market and has 262 million subscribers across Latin America, but never made it to Talea.

Alejandro Lopez, a senior town hall official, said the village had approached big telecom firms, but that they had required 10,000 potential users as well as the construction of a path where an antenna would be erected and a lengthy power line.

“Despite some technical problems, because we are in a test period, the project has been a success,” with 600 villagers signing up since the service opened three months ago, Lopez said.

Buoyed by the system’s success, the village has decided to buy its own equipment that will allow RCT to run 35 lines simultaneously and plans to install them in the coming weeks.

Hernandez said the next step is to form cooperatives with other indigenous villages to request concessions from the Mexican government to resolve “this lack of free frequencies for cellphone communications in the country’s rural communities.”

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) would not produce its most advanced technologies in the US next year, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. Kuo made the comment during an appearance at the legislature, hours after the chipmaker announced that it would invest an additional US$100 billion to expand its manufacturing operations in the US. Asked by Taiwan People’s Party Legislator-at-large Chang Chi-kai (張啟楷) if TSMC would allow its most advanced technologies, the yet-to-be-released 2-nanometer and 1.6-nanometer processes, to go to the US in the near term, Kuo denied it. TSMC recently opened its first US factory, which produces 4-nanometer

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

REACTIONS: While most analysts were positive about TSMC’s investment, one said the US expansion could disrupt the company’s supply-demand balance Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) new US$100 billion investment in the US would exert a positive effect on the chipmaker’s revenue in the medium term on the back of booming artificial intelligence (AI) chip demand from US chip designers, an International Data Corp (IDC) analyst said yesterday. “This is good for TSMC in terms of business expansion, as its major clients for advanced chips are US chip designers,” IDC senior semiconductor research manager Galen Zeng (曾冠瑋) said by telephone yesterday. “Besides, those US companies all consider supply chain resilience a business imperative,” Zeng said. That meant local supply would

Servers that might contain artificial intelligence (AI)-powering Nvidia Corp chips shipped from the US to Singapore ended up in Malaysia, but their actual final destination remains a mystery, Singaporean Minister for Home Affairs and Law K Shanmugam said yesterday. The US is cracking down on exports of advanced semiconductors to China, seeking to retain a competitive edge over the technology. However, Bloomberg News reported in late January that US officials were probing whether Chinese AI firm DeepSeek (深度求索) bought advanced Nvidia semiconductors through third parties in Singapore, skirting Washington’s restrictions. Shanmugam said the route of the chips emerged in the course of an