Greece’s government formally asked investors to exchange their holdings of government debt for new securities in the biggest sovereign restructuring in history.

“The Ministerial Council of the Hellenic Republic today approved the terms of invitations to be made to private sector holders,” the Greek Ministry of Finance said in a statement on Friday on a Web site set up for the exchange.

The bonds subject to the invitation had a total face value of about 206 billion euros (US$277 billion).

The government seeks a 90 percent participation rate and set a 75 percent rate as a threshold for proceeding with the transaction, according to the statement.

Parliament approved laws on Thursday to permit the exchange and cut 106 billion euros of the country’s debt. Private creditors gave their backing earlier this week as eurozone finance ministers weighed a 130 billion-euro package for the nation, its second rescue.

Institute of International Finance managing director Charles Dallara, who represented private bondholders in debt-writedown talks with the government, said he expected a majority of investors to agree to a voluntary bond swap.

“I’m quite optimistic,” Dallara told reporters in Mexico City ahead of a meeting yesterday of finance officials from the G20 nations.

He said that he expected “a high take-up” among bondholders.

The swap is required to secure the European bailout and is geared toward averting the collapse of the Greek economy and default by a member of the euro. The exchange must be completed before March 20, when the country has to redeem 14.5 billion euros of bonds. In return, Greece has promised 3.2 billion euros of public-spending cuts.

The nation’s debt was forecast to balloon to almost double the size of its shrinking economy this year without the write-off, the European Commission said in November.

There’s a “titanic” effort under way to push through plans to reduce wages for civil servants and cut spending on defense, education and healthcare, Greek Prime Minister Lucas Papademos said on Friday at a Cabinet meeting in Athens.

Investors will forgive 53.5 percent of their principal and exchange the remaining holdings for Greek government bonds and notes from the European Financial Stability Facility (EFSF). The coupon on the new bonds was set at 2 percent until February 2015, 3 percent for the following five years, 3.65 percent for 2021 and 4.3 percent until 2042.

Bondholders will exchange 31.5 percent of their principal into 20 new Greek government bonds with maturities of 11 to 30 years and the remaining 15 percent into short-dated securities issued by the EFSF. The new securities will be governed by British law.

Fitch Ratings on Wednesday cut Greece’s credit grade two levels after the country got approval to proceed with the exchange, reducing the long-term foreign and local currency issuer default ratings to “C” from “CCC.”

“The proposal to reduce Greece’s public debt burden via a debt exchange with private creditors will, if completed, constitute a rating default,” Fitch said in a statement. “The exchange, if completed, would constitute a distressed debt exchange.”

Fitch said the country would get a “restricted default” rating after the swap starts, one level above “default.”

Once the transaction is completed, it will be moved out of that category and “re-rated at a level consistent with the agency’s assessment of its post-default structure and credit profile,” Fitch said.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Taiwan’s foreign exchange reserves hit a record high at the end of last month, surpassing the US$600 billion mark for the first time, the central bank said yesterday. Last month, the country’s foreign exchange reserves rose US$5.51 billion from a month earlier to reach US$602.94 billion due to an increase in returns from the central bank’s portfolio management, the movement of other foreign currencies in the portfolio against the US dollar and the bank’s efforts to smooth the volatility of the New Taiwan dollar. Department of Foreign Exchange Director-General Eugene Tsai (蔡炯民)said a rate cut cycle launched by the US Federal Reserve

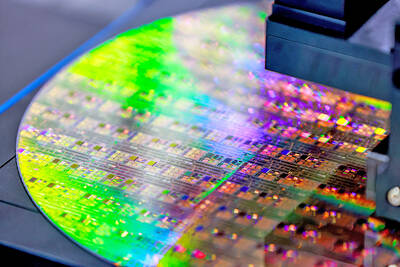

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional