Not to be outdone by Acer Inc (宏碁), which debuted the so-called “world’s thinnest” Ultrabook at the International Consumer Electronics Show (CES) in Las Vegas, Asustek Computer Inc (華碩電腦) and HTC Corp (宏達電) are aiming to dazzle consumers at the show by unveiling a 7-inch tablet PC and a Windows Phone that runs on the Long Term Evolution (LTE) network respectively.

Asustek said it is planning for a second-quarter release for its much-delayed Eee Pad Memo, a tablet that was initially announced at last year’s CES, one of the world’s largest consumer electronics shows.

The 7-inch tablet comes with a stylus and has a display with a 1,280x800 resolution and an 8 megapixel camera.

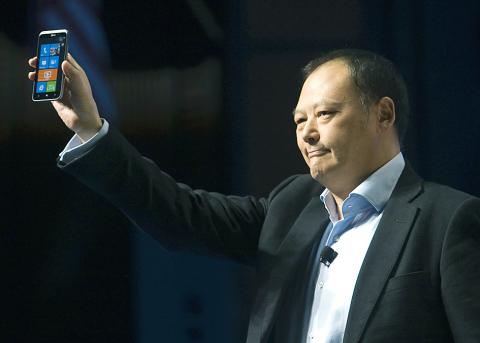

Photo: Reuters

The Memo is equipped with an Nvidia Corp Tegra quad-core processor, 1 gigabyte (GB) of RAM and internal storage of up to 32GB and runs on Android 4.0 — codenamed Ice Cream Sandwich.

The retail price is US$249, according to Asustek’s statement.

HTC, meanwhile, unveiled its first Windows Phone, the Titan II, which runs on the high-speed 4G LTE.

The phone will be sold through AT&T Inc, the second-largest mobile provider in the US.

The 4.7-inch Titan II uses Qualcomm Inc’s 1.5 gigahertz Snapdragon S2 processor and a 16 megapixel camera, enabling fast Web surfing, streaming and downloading, as well as 720p HD video recording.

HTC said the new smartphone, which uses Microsoft Corp’s Windows Mango Phone operating system, would hit AT&T store shelves within several months, but it did not give any specifics on the product’s release date or pricing.

In related news, HTC yesterday said it has enforced an internal performance examination plan as part of a regular program that could lay off some staff.

“It’s called the ‘Performance Improvement Plan’ and we have run it for many years,” said Annie Lu (盧佳琪), a company spokeswoman.

“Our management can launch this plan at any time it thinks some employees need it. These employees will need to achieve several goals set by the company in three to six months to improve their performance, or they will be laid off,” Lu said.

HTC has told employees with working performance ranking in the lowest 5 to 10 percent in each department to take part in the program for further training, according to the Liberty Times (the Taipei Times’ sister newspaper) yesterday.

The paper said HTC hopes to form another growth driver by getting rid of unwanted workers “in a normal and healthy way,” — a measure currently undertaken by many other high-tech firms.

With this year’s Semicon Taiwan trade show set to kick off on Wednesday, market attention has turned to the mass production of advanced packaging technologies and capacity expansion in Taiwan and the US. With traditional scaling reaching physical limits, heterogeneous integration and packaging technologies have emerged as key solutions. Surging demand for artificial intelligence (AI), high-performance computing (HPC) and high-bandwidth memory (HBM) chips has put technologies such as chip-on-wafer-on-substrate (CoWoS), integrated fan-out (InFO), system on integrated chips (SoIC), 3D IC and fan-out panel-level packaging (FOPLP) at the center of semiconductor innovation, making them a major focus at this year’s trade show, according

DEBUT: The trade show is to feature 17 national pavilions, a new high for the event, including from Canada, Costa Rica, Lithuania, Sweden and Vietnam for the first time The Semicon Taiwan trade show, which opens on Wednesday, is expected to see a new high in the number of exhibitors and visitors from around the world, said its organizer, SEMI, which has described the annual event as the “Olympics of the semiconductor industry.” SEMI, which represents companies in the electronics manufacturing and design supply chain, and touts the annual exhibition as the most influential semiconductor trade show in the world, said more than 1,200 enterprises from 56 countries are to showcase their innovations across more than 4,100 booths, and that the event could attract 100,000 visitors. This year’s event features 17

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass