As grime-covered men emerge from deep shafts on the Philippines’ “golden mountain,” Norie Palma eagerly prepares to haggle for her share of ore from the weary miners.

The former laundrywoman turned gold buyer directs the procession to her small milling shack amid grunts from the miners whose backs are stooped under the weight of their hauls from the dangerous honeycomb tunnels of Mount Diwata.

“It is like this everyday. People are always digging, searching and haggling for that stone with the best gold,” said Palma, a 36-year-old mother of four who runs one of many backyard mining operations on Mount Diwata. “Gold is what we live for on this mountain.”

Photo: AFP

With global gold prices rising as investors park their funds in the precious metal to hedge against an uncertain global economy, Palma said she and other prospectors on Mount Diwata were enjoying a windfall.

Gold hit a record high of US$1,921.15 an ounce early last month and, although it has since fallen back, some analysts have forecast it will hit the US$2,000 mark this year.

A college dropout, Palma’s operation has lately been producing thousands of dollars’ worth of gold — a fortune in the impoverished Philippines.

Photo: AFP

“You could say gold changed our life. I now have the money to buy the things that I want,” she said. “And we want more of it while the prices are high.”

Palma buys the ore dug up by miners who do not have the means to process it, then trades with jewellers and brokers who regularly make the arduous trip up the 2,012m mountain to buy the yellow nuggets.

The Philippines has some of the biggest gold and other mineral deposits in the world, according to the US government, but the country’s official mining industry is relatively small and hard to access for foreign firms.

Illegal mining, in which individuals or small-scale ventures simply start digging on vacant land, is rampant.

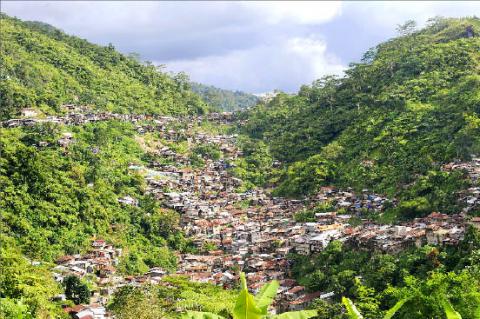

Mount Diwata — located in the violence-plagued and often lawless southern region of Mindanao — is the country’s biggest and most famous of these “gold rush” sites.

It has yielded at least 2.7 million ounces of high grade ore since a tribesman first discovered gold there three decades ago, according to local government data.

The discovery of gold on the mountain triggered a mad rush of people from all walks of life, from military deserters and ex-communist rebels to gun runners and ordinary folk dreaming of that life-changing haul.

The government estimates that at the height of the gold fever in the early 1980s, the population in the area peaked at nearly 100,000.

The present population is believed to be 40,000, according to officials, but they said more miners had started returning to the area recently to take advantage of the rising prices.

However, Mount Diwata is as famous for the misery it has wrought upon the miners and the destruction of the local environment as it is for the riches enjoyed by the lucky ones.

The first generation miners and their families settled in small cliff-side shacks and dug tunnels under their homes, creating the blueprint for a chaotic and dangerous existence in which many of the laws of society and nature were ignored.

Highly toxic mercury is used in the mining process, polluting the Naboc stream that cuts through the village.

Armed disputes erupted between rival miners and their thugs, according to local village chief Rodolfo Boyles, himself an ex-miner, although he said violence dropped after the military stationed some troops there nine years ago.

He said hundreds of people had also perished in cave-ins and other mine-related accidents.

The hardships of working the mines have earned Diwata the tag “diwalwal,” local slang referring to tongues that hang out after a hard day’s labor in the tunnels.

“When you enter the mines your life is already at stake, you might be buried there or you might get hit by falling rock,” said Dandy Labrador, 28, who left his work as a security guard to become a miner. “It is dangerous and anything can happen.”

Labrador said he arrived at Mount Diwata several years ago filled with dreams of striking it rich, but found that fortune--hunting was backbreaking work.

Like the vast bulk of the miners, Labrador works as a hired hand and is paid with a share of the ore that he digs up. He then sells his ore to brokers.

Still, Labrador said he earned more than he would as a construction worker or laborer in Manila.

“I have not given up on my dream of becoming rich,” he said.

Boyles said there had long been a plan to bring in big mining firms with modern extraction methods and make the operations there legal, but small miners had resisted the idea and continued to virtually control Mount Diwata.

With the high global gold prices, the government is concerned that there will be more Mount Diwata-style operations around the country.

Phillipine Environment Secretary Ramon Paje recently said 70 percent of gold produced in the country already came from illegal mines.

“There is the possibility of a gold rush, because gold is the safest commodity right now,” he said. “But we have to manage our resources well ... this is not the kind of mining we want to encourage.”

SPEED OF LIGHT: US lawmakers urged the commerce department to examine the national security threats from China’s development of silicon photonics technology US President Joe Biden’s administration on Monday said it is finalizing rules that would limit US investments in artificial intelligence (AI) and other technology sectors in China that could threaten US national security. The rules, which were proposed in June by the US Department of the Treasury, were directed by an executive order signed by Biden in August last year covering three key sectors: semiconductors and microelectronics, quantum information technologies and certain AI systems. The rules are to take effect on Jan. 2 next year and would be overseen by the Treasury’s newly created Office of Global Transactions. The Treasury said the “narrow

SPECULATION: The central bank cut the loan-to-value ratio for mortgages on second homes by 10 percent and denied grace periods to prevent a real-estate bubble The central bank’s board members in September agreed to tighten lending terms to induce a soft landing in the housing market, although some raised doubts that they would achieve the intended effect, the meeting’s minutes released yesterday showed. The central bank on Sept. 18 introduced harsher loan restrictions for mortgages across Taiwan in the hope of curbing housing speculation and hoarding that could create a bubble and threaten the financial system’s stability. Toward the aim, it cut the loan-to-value ratio by 10 percent for second and subsequent home mortgages and denied grace periods for first mortgages if applicants already owned other residential

EXPORT CONTROLS: US lawmakers have grown more concerned that the US Department of Commerce might not be aggressively enforcing its chip restrictions The US on Friday said it imposed a US$500,000 penalty on New York-based GlobalFoundries Inc, the world’s third-largest contract chipmaker, for shipping chips without authorization to an affiliate of blacklisted Chinese chipmaker Semiconductor Manufacturing International Corp (SMIC, 中芯). The US Department of Commerce in a statement said GlobalFoundries sent 74 shipments worth US$17.1 million to SJ Semiconductor Corp (盛合晶微半導體), an affiliate of SMIC, without seeking a license. Both SMIC and SJ Semiconductor were added to the department’s trade restriction Entity List in 2020 over SMIC’s alleged ties to the Chinese military-industrial complex. SMIC has denied wrongdoing. Exports to firms on the list

TECHNOLOGY EXIT: The selling of Apple stock might be related to the death of Berkshire vice chairman Charlie Munger last year, an analyst said Billionaire Warren Buffett is now sitting on more than US$325 billion in cash after continuing to unload billions of US dollars worth of Apple Inc and Bank of America Corp shares this year and continuing to collect a steady stream of profits from all of Berkshire Hathaway Inc’s assorted businesses without finding any major acquisitions. Berkshire on Saturday said it sold off about 100 million more Apple shares in the third quarter after halving its massive investment in the iPhone maker the previous quarter. The remaining stake of about 300 million shares was valued at US$69.9 billion at the end of