Taiwan’s once-booming textile industry entered this decade in need of a wake-up call, with global competition having reduced exports by more than a third. However, one firm has received a boost from a surprising source: coffee.

The S. Cafe fabric, made by Singtex Industrial Co (興采實業), incorporates recycled coffee grounds from Starbucks and 7-Eleven, and has proved to be a hit with heavyweight international brands including Nike and North Face.

Industry figures say the fiber — more than three years in development and sold under the slogan “Drink it, wear it” — shows how the sector might reinvent itself as green, savvy and even cool.

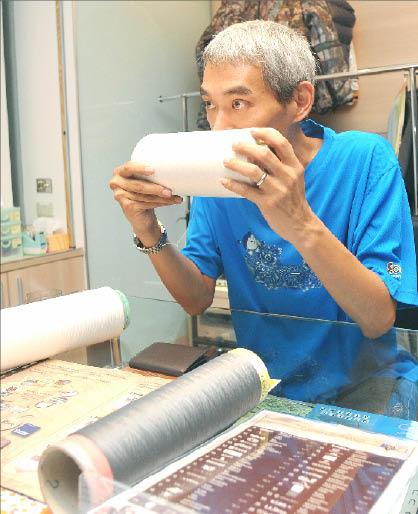

Photo: AFP, Patrick Lin

“S. Cafe fiber marks a technological breakthrough in the company’s research and development,” said Jason Chen (陳國欽), the company’s 50-year-old chairman, who drinks four cups of coffee a day.

The nation’s textile exports peaked in 1997 with a value of US$16.7 billion, but since then overseas shipments have been declining, as wages have gone up while tough and nimble rivals have emerged in China.

Partly because of the global financial crisis, exports hit a nadir of US$9.4 billion in 2009, according to figures compiled by Taiwan Textile Research Institute (紡織產業綜合研究所), a semi-official industry research unit.

Yet Frank Hsu (許文正), deputy secretary-general of the Taiwan Textile Federation (台灣紡拓會), says this is not the end of the story.

“The textile industry is by no means a ‘sunset industry,’” he said. “Rather, the sun is right above our heads.”

The textile sector, in which 4,000 companies now employ about 190,000 workers, needs a renaissance, but it may not be easy — and it definitely will not be cheap.

Singtex spent NT$50 million (US$1.7 million), or about a third of its capital, to develop its new fabric, about 2 percent of which is coffee extracts, with the rest polyester or nylon. However, the investment has paid off.

S. Cafe revenues came in at about NT$100 million last year and sales from fiber-related businesses have hit NT$170 million in the five months to May, accounting for 20 percent of the company’s revenues.

The addition of coffee grounds helps to control odors and protect against UV rays, as well as enabling the fabric to dry faster. However, too many grounds would make the fibers snap easily, meaning the process had to be finely calibrated.

The results have created a buzz. US outdoor footwear and apparel giant Timberland describes a jacket using the fabric as “our most environmentally conscious performance jacket ever.”

Altogether, Singtex supplies fabric to nearly 70 globally noted brands, from Germany’s Puma to Japan’s Mizuno.

Its secret was helping those firms make environmental concerns part of their corporate image.

“This is a smart marketing strategy. It speaks directly to the hearts of environmentally conscious consumers,” said Yin Cheng-ta, a Taiwan Textile Research Institute official.

As the industry seeks fresh vitality, Singtex’s success is remarkable, but not unique. Inventiveness has become a necessity for companies who have not moved their production to low-cost areas in China and Southeast Asia.

Several firms have branched out into creating fine fibers, with companies including Nan Ya Plastics Co (南亞塑膠), Zig Sheng Industrial Co (集盛實業) and Chain Yarn Co (展頌) producing yarns with less than five denier — compared with a normal 75 denier.

“Cloth made of such yarns is so fine that it is usually described as ‘second skin’ — it’s almost like the skin of babies,” Yin said.

Cloth made of such fine yarns sells for about US$5 per meter, compared with US$1 or US$2 for normal cloth.

However, the dyeing and -manufacturing processes are so demanding that only a few countries, such as Italy and Taiwan, produce the cloth, he added.

Hsu said he was optimistic about the outlook for the industry despite the drop in volumes. Profit margins are currently a healthy 20 percent, he said.

Still, Chen said that innovation is a challenge for small textile businesses in Taiwan, which spend an average 1.7 percent to 2 percent of their yearly revenues on research compared with Singtex’s 3.5 percent spend.

“Maintaining the niche isn’t easy,” he said.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors