Alaska officials are looking to China and what some believe will be that country’s strong demand for natural gas to help the state advance its long-held pipeline dreams.

Alaska Governor Sean Parnell has invited an official with China’s National Energy Administration and others to visit Alaska, following up on a trade mission Lieutenant-Governor Craig Campbell helped lead to China in December.

Campbell returned from that trip believing the rapidly developing nation, already a leading export market for such Alaska products as seafood, zinc and lead ore, could also become a major investor in or export market for Alaska natural gas or its byproducts.

The potential for Alaska is huge, said Alaska Natural Gas Development Authority chief executive Harold Heinze, who was with Campbell on the trip.

Heinze said he saw several possibilities for China, from building a plant to convert ethane to pellets that would be used in manufacturing to signing on with a major natural gas pipeline project. Ethane is a component for plastics that he says is found in the Prudhoe Bay region.

“One thing you look for in a partner is, do they have money and do they have more money than you. And these guys have money,” he said, adding: “They’re major players in the world.”

In theory, if the interest and money are there, that could also spur progress on a pipeline that many Alaskans have long looked to for new jobs, reliable energy and as a source for more state revenue amid projections of slumping oil production.

But there are plenty of uncertainties, from permitting and pricing — how gas holds up against other energy sources — to what China’s true long-term demands for gas will be over alternatives like coal, and the level of competition Alaska would face from other producers to meet the gas demand.

And there are the various pipeline options and plans, each with diehard constituencies and questions about their viability.

Estimates released last month by the companies working with the state to advance a major line put the project costs at US$20 billion to US$41 billion, depending on the route.

One route, the cheaper option, estimated at US$20 billion to US$26 billion, would run from the harsh North Slope to Valdez, Alaska, where gas would be liquefied at a facility that another entity would build and then shipped elsewhere, possibly overseas. The plant cost isn’t included in the estimates.

The costlier option envisions a pipeline going from the North Slope to Canada, where gas could move on existing systems to North American markets.

But there have been numerous other proposals through the years to move North Slope gas, even a bullet line to move the gas to the most populated part of the state, southcentral Alaska.

“The Chinese may, because they’re interested in resources, they may be able to do things and invest in things that don’t look economic in market terms,” said James Jensen, a consultant in natural gas economics.

“In fact, if the Chinese said, ‘Gee, if we could get this thing going and we could tie up a certain amount of American gas for our own use,’ they might do something that I wouldn’t think would be economic,” he said. “But they might do it.”

Officials with TransCanada Corp, based in Calgary, Alberta, and Irving, Texas-based Exxon Mobil Corp, say the project is economically viable and hope to move toward an “open season,” when they can court gas producers and try to secure commitments for shipping deals, by May.

The companies, in a recent filing with federal regulators, estimated 991 billion cubic meters of proven gas reserves on the North Slope.

Through a process in which TransCanada beat out applicants including a Chinese company several years ago, the state agreed to reimburse up to US$500 million of the eligible costs of the project.

A TransCanada spokeswoman declined comment on whether there had been interest from China on the project, saying: “All discussions with individual customers are confidential and we would not be able to discuss any individual details as a result of that.”

A rival project by Britain’s BP PLC and Houston-based ConocoPhillips is also moving ahead.

Campbell said he was not advocating any specific project, but he’d like Chinese officials to visit “earlier, rather than later.”

They have indicated a “huge demand,” for natural gas, he said, and Alaska wants a market.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

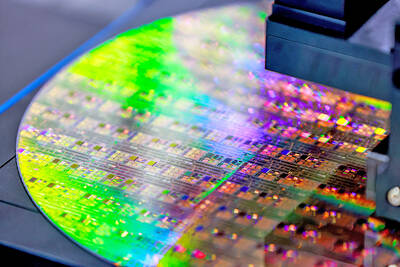

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

Pegatron Corp (和碩), a key assembler of Apple Inc’s iPhones, on Thursday reported a 12.3 percent year-on-year decline in revenue for last quarter to NT$257.86 billion (US$8.44 billion), but it expects revenue to improve in the second half on traditional holiday demand. The fourth quarter is usually the peak season for its communications products, a company official said on condition of anonymity. As Apple released its new iPhone 17 series early last month, sales in the communications segment rose sequentially last month, the official said. Shipments to Apple have been stable and in line with earlier expectations, they said. Pegatron shipped 2.4 million notebook