Taiwan’s chip makers, powerful drivers of growth in the nation, may have survived their worst crisis ever, but lackluster sales and new rivals still make these risky times.

The local semiconductor industry, the fourth-largest in the world, saw sales soar by a steep margin in the second quarter, but is set to become markedly less feverish in the third quarter, analysts said.

“The slowing pace of growth shows the global recovery may not be as fast as previously anticipated,” said Mars Hsu, a Taipei-based technology analyst with Grand Cathay Securities (大華證券).

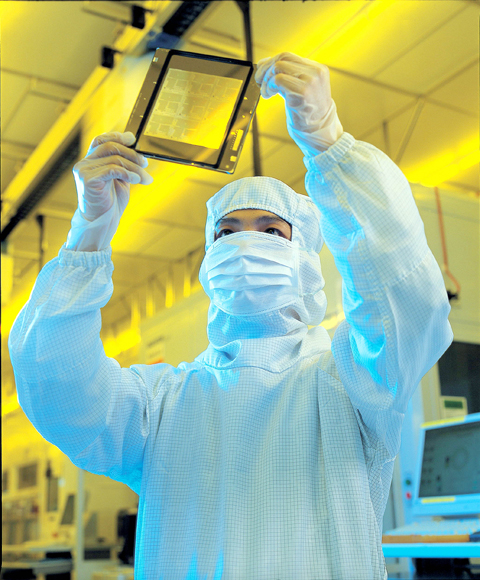

PHOTO: AFP

In the three months to June, combined revenues of the nation’s chip makers soared 69.2 percent from the previous quarter to NT$136.2 billion (US$4.18 billion), the Taiwan Semiconductor Industry Association (TSIA, 台灣半導體協會) said.

This followed a record 33.7 percent quarter-on-quarter drop in the three months to March for an industry that, more than any other, helped give Taiwan its reputation as a high-tech nation.

The pickup in sales in the second quarter was largely due to unique factors, such as a need among clients to rebuild inventories after the immediate shocks of the worst crisis in decades.

“Clients found their inventories were low as a result of the uncertainty that gripped the market after the crisis last year,” said Peng Mao-jung (彭茂榮), an analyst of the quasi-official Industrial Technology Research Institute (ITRI, 工研院).

Contributing to the fast pace of growth in the second quarter was also another one-off factor — a rush of orders from China after the Chinese government adopted massive stimulus spending to lift its flagging economy.

One-offs do not last long, and analysts suspect that the industry may be losing momentum with Peng forecasting growth of just 17 percent in the third quarter from the second.

The 17 percent growth forecast is shared by United Microelectronics Corp (UMC, 聯電), the world’s No. 2 contract microchip maker.

The company has said its demand in the third quarter, a typically busy period of the year for the chip industry, has slowed because of rising economic uncertainties.

The upshot is that the nation’s chip output will reach NT$541.5 billion this year, marking a 17.2 percent fall from the previous year.

“Basically, despite the strong rebound in the recent months, this is not going to be a good year for the local semiconductor industry,” Peng said.

On top of this, Taiwan’s chip manufacturers are now bracing themselves for a challenge from an unusual quarter — the Middle East.

Abu Dhabi investment firm Advanced Technology Investment Company (ATIC) has offered to buy Singapore’s Chartered Semiconductor Manufacturing Ltd (特�?or US$3.9 billion.

ATIC is also the main shareholder in Globalfoundries, a joint venture with US firm Advanced Micro Devices Inc (AMD).

Chartered Semiconductor and Globalfoundries together account for around 13 percent of the global market in terms of foundry services.

Although this is still dwarfed by the 49 percent held by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), it does reflect tectonic shifts in the global chip industry facilitated by the financial crisis, observers said.

“The global recession has opened up a number of opportunities for the strong to get stronger,” said Len Jelinek, a chief analyst at the iSuppli Corp, a California-based research and consultancy firm.

“[This is] causing a dramatic shift in who will be the leaders in the pure-play foundry market for years to come,” he said.

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

The US Federal Reserve is expected to announce a pause in rate cuts on Wednesday, as policymakers look to continue tackling inflation under close and vocal scrutiny from US President Donald Trump. The Fed cut its key lending rate by a full percentage point in the final four months of last year and indicated it would move more cautiously going forward amid an uptick in inflation away from its long-term target of 2 percent. “I think they will do nothing, and I think they should do nothing,” Federal Reserve Bank of St Louis former president Jim Bullard said. “I think the

‘LASER-FOCUSED’: Trump pledged tariffs on specific sectors, including semiconductors, pharmaceuticals, steel, copper and aluminum, and perhaps even cars US President Donald Trump said he wants to enact across-the-board tariffs that are “much bigger” than 2.5 percent, the latest in a string of signals that he is preparing widespread levies to reshape US supply chains. “I have it in my mind what it’s going to be but I won’t be setting it yet, but it’ll be enough to protect our country,” Trump told reporters on Monday night. Asked about a report that incoming US Secretary of the Treasury Scott Bessent favored starting with a global rate of 2.5 percent, Trump said he did not think Bessent supported that and would not