Amid growing signs of an easing of the economic crisis, Wall Street has managed to keep a mostly sunny outlook even though a six-week rally came to a halt.

After a heavy week of earnings reports prompted some turbulence, the market will focus on economic news and the outlook for the auto sector with two of the “Big Three” manufacturers on the ropes.

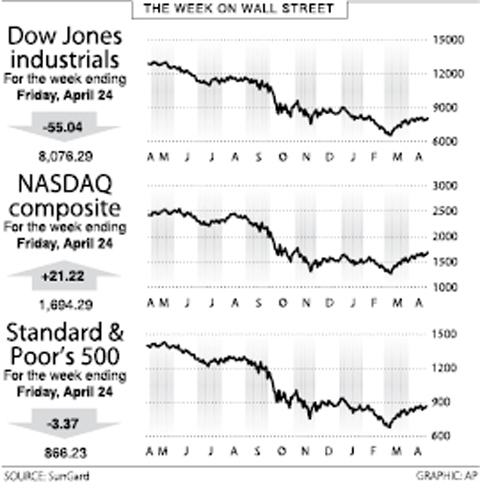

In the week to Friday, the Dow Jones Industrial Average of blue-chips fell 0.68 percent and the Standard & Poor’s 500 broad-market index dipped 0.39 percent.

This ended a six-week rally that analysts said had been the best since 1938.

The tech-heavy NASDAQ, however, extended its gains to a seventh week, rising 1.27 percent to 1,694.29, its best level since last November.

Although market’s stunning six-week rally took a breather, analysts say the tone remains positive amid hopes for an end to the deep recession and grueling bear market.

“Increasingly we are seeing greater numbers of economists saying that improvement in the economy will be clearly evident late this year,” Gregory Drahuschak at Janney Montgomery Scott said. “The market will not wait for the data.”

Investors have latched on to both corporate and economic news that, while far from upbeat, suggests a bottom may be near if not already here.

Benjamin Reitzes at BMO Capital Markets said after data showed a 0.6 percent drop in new home sales that “this is the latest housing market indicator to show signs of a potential bottom.”

“Financial markets, to varying degrees, have begun to price in economic recovery,” Julian Callow at Barclays Capital said. “A key issue for the weeks and months ahead will be whether economic indicators improve in a way that validates this.”

Others were more skeptical.

“The rally has been driven by bullish sentiments rather than by bullish fundamentals,” Ed Yardeni at Yardeni Research said. “That’s fine as long as the fundamentals that drive earnings start to actually improve, and not just worsen at a slower pace.”

Nouriel Roubini, a New York University economist, calls the rally a “dead-cat bounce.”

“In the last two years, the stock market has predicted six out of the last zero economic recoveries — that is, six bear market rallies that eventually fizzled and led to new lows,” he said.

Roubini said growth will falter “and earnings of corporations and financial institutions will not rebound as fast as the consensus predicts,” dampening any recovery.

Fred Dickson at DA Davidson & Co said the market tone is improving along wiht corporate and economic news.

“Unlike last quarter, this quarter we are seeing analysts raise estimates following positive earnings surprise announcements. This has kept investor enthusiasm for stocks reasonably high,” he said.

“Investors will need to see growing evidence that the economy is close to turning the corner to ignite the second stage of the current rally. The second stage is normally fueled by frightened money managers who are scrambling to play catch up with the market averages and their performance benchmarks after sitting out the first stage of a new bull market with lots of cash,” Dickson said.

In the coming week, the market will see the initial estimate for US economic activity in the first quarter.

The expectation is that the economy contracted at a 4.9 percent pace, which is dismal but not as bad as the 6.3 percent drop in the fourth quarter of last year.

The yield on the 10-year US Treasury bond increased to 2.996 percent against 2.930 percent a week earlier and that on the 30-year bond rose to 3.876 percent from 3.785 percent.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) would not produce its most advanced technologies in the US next year, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. Kuo made the comment during an appearance at the legislature, hours after the chipmaker announced that it would invest an additional US$100 billion to expand its manufacturing operations in the US. Asked by Taiwan People’s Party Legislator-at-large Chang Chi-kai (張啟楷) if TSMC would allow its most advanced technologies, the yet-to-be-released 2-nanometer and 1.6-nanometer processes, to go to the US in the near term, Kuo denied it. TSMC recently opened its first US factory, which produces 4-nanometer

PROTECTION: The investigation, which takes aim at exporters such as Canada, Germany and Brazil, came days after Trump unveiled tariff hikes on steel and aluminum products US President Donald Trump on Saturday ordered a probe into potential tariffs on lumber imports — a move threatening to stoke trade tensions — while also pushing for a domestic supply boost. Trump signed an executive order instructing US Secretary of Commerce Howard Lutnick to begin an investigation “to determine the effects on the national security of imports of timber, lumber and their derivative products.” The study might result in new tariffs being imposed, which would pile on top of existing levies. The investigation takes aim at exporters like Canada, Germany and Brazil, with White House officials earlier accusing these economies of

Teleperformance SE, the largest call-center operator in the world, is rolling out an artificial intelligence (AI) system that softens English-speaking Indian workers’ accents in real time in a move the company claims would make them more understandable. The technology, called accent translation, coupled with background noise cancelation, is being deployed in call centers in India, where workers provide customer support to some of Teleperformance’s international clients. The company provides outsourced customer support and content moderation to global companies including Apple Inc, ByteDance Ltd’s (字節跳動) TikTok and Samsung Electronics Co Ltd. “When you have an Indian agent on the line, sometimes it’s hard

‘SACRED MOUNTAIN’: The chipmaker can form joint ventures abroad, except in China, but like other firms, it needs government approval for large investments Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) needs government permission for any overseas joint ventures (JVs), but there are no restrictions on making the most advanced chips overseas other than for China, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. US media have said that TSMC, the world’s largest contract chipmaker and a major supplier to companies such as Apple Inc and Nvidia Corp, has been in talks for a stake in Intel Corp. Neither company has confirmed the talks, but US President Donald Trump has accused Taiwan of taking away the US’ semiconductor business and said he wants the industry back