A six-week rally in Asian stocks faltered this week, as earnings from companies such as China Mobile Ltd and KDDI Corp reduced optimism the global economy is recovering.

China Mobile (中國移動通信), the world’s biggest wireless carrier, sank 6.6 percent in Hong Kong after first-quarter profit grew at the slowest rate in five years. KDDI, Japan’s second biggest, lost 6 percent after projecting the slowest earnings growth since 2006. PCCW Ltd, Hong Kong’s biggest phone carrier, slumped 16 percent as Chairman Richard Li abandoned his US$2.1 billion takeover bid.

“You’re seeing cold water being poured on the theme of a sharp rebound in growth,” said Tim Schroeders, who helps manage about US$1 billion at Pengana Capital Ltd in Melbourne. “It’s encouraging that a bottom has been perceived, but given the likelihood of a protracted period of low growth, some of these share prices ran ahead of reality.”

PHOTO: BLOOMBERG

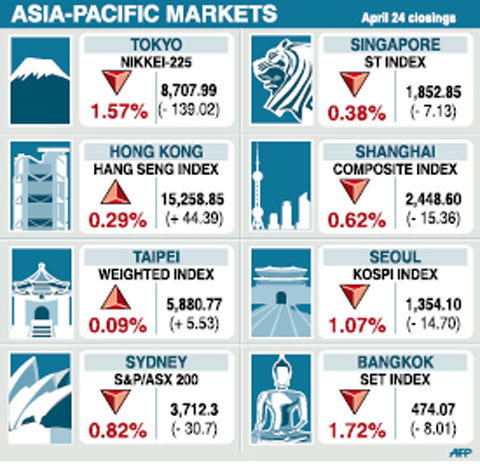

The MSCI Asia-Pacific Index slipped 0.2 this week to 89.52, following a 25 percent rally in the previous six weeks. It plunged by a record 43 percent last year as the credit crunch tipped the world’s largest economies into recession, forcing companies to cut jobs amid slumping profits.

Japan’s Nikkei 225 Stock Average and Hong Kong’s Hang Seng Index both declined 2.2 percent. Thailand’s SET Index advanced 3.8 percent as Thai Prime Minister Abhisit Vejjajiva ended 12 days of emergency rule in Bangkok, saying the nation has “returned to normal.”

Taiwanese share prices are expected to meet further technical resistance ahead of the psychological 6,000-point level, dealers said on Friday.

As the market repeatedly failed to pass the figure in the past few sessions, investors have kept alert on possible technical corrections after the bourse had staged significant gains recently, they said.

Market sentiment has become cautious before Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s largest contract microchip maker, reports its first quarter results on Thursday, they added.

Investors are also watching closely how the US auto sector will resolve its financial difficulties and how Wall Street reacts to the development, they said.

While it is possible for the market to challenge 6,000 points again next week, downside pressure is expected to drag the index down with technical support at around 5,600, dealers said.

In the week to Friday, the weighted index rose 125.39 points, or 2.18 percent, to 5,880.77 after a 0.5 percent decline a week earlier.

Average daily turnover stood at NT$130.81 billion (US$3.88 billion), compared with NT$168.57 billion a week ago.

“The market is waiting for TSMC’s comments on an outlook of the global high tech industry,” Taiwan International Securities (金鼎證券) analyst Arch Shih (施博元) said.

Taiwan’s economy has been badly hit as its electronics exports suffered steep declines amid a global economic meltdown. While major high-tech firms have canceled unpaid leave after receiving large orders from China, “investors need real numbers. The upcoming TSMC investor conference is the key,” Shih said.

Other markets on Friday:

BANGKOK: Up 1.72 percent. The Stock Exchange of Thailand composite index gained 8.01 points to 474.07. Investors welcomed the lifting of a state of emergency in and around Bangkok before profit-taking later in the day, dealers said.

KUALA LUMPUR: Up 1.40 percent. The Kuala Lumpur Composite Index gained 14.04 points to 992.68.

JAKARTA: Flat. The Jakarta Composite Index lost 1.37 points to 1,591.33.

MANILA: Up 1.7 percent. The composite index gained 35.33 points to 2,103.63. The market was lifted by regulators’ approval of a rate hike by Meralco, the country’s biggest power distributor, as well as moves in Congress to push for amendments to the constitution to remove a ban on foreigners from owning land.

WELLINGTON: Flat. The NZX-50 index fell 2.46 points to 2,656.39.

MUMBAI: Up 1.74 percent. The 30-share SENSEX rose 194.06 points to 11,329.05.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

‘SILVER LINING’: Although the news caused TSMC to fall on the local market, an analyst said that as tariffs are not set to go into effect until April, there is still time for negotiations US President Donald Trump on Tuesday said that he would likely impose tariffs on semiconductor, automobile and pharmaceutical imports of about 25 percent, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the US leader’s trade war. “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25 percent,” Trump told reporters at his Mar-a-Lago club when asked about his plan for auto tariffs. Asked about similar levies on pharmaceutical drugs and semiconductors, the president said that “it’ll be 25 percent and higher, and it’ll

CHIP BOOM: Revenue for the semiconductor industry is set to reach US$1 trillion by 2032, opening up opportunities for the chip pacakging and testing company, it said ASE Technology Holding Co (日月光投控), the world’s largest provider of outsourced semiconductor assembly and test (OSAT) services, yesterday launched a new advanced manufacturing facility in Penang, Malaysia, aiming to meet growing demand for emerging technologies such as generative artificial intelligence (AI) applications. The US$300 million facility is a critical step in expanding ASE’s global footprint, offering an alternative for customers from the US, Europe, Japan, South Korea and China to assemble and test chips outside of Taiwan amid efforts to diversify supply chains. The plant, the company’s fifth in Malaysia, is part of a strategic expansion plan that would more than triple

Taiwanese artificial intelligence (AI) server makers are expected to make major investments in Texas in May after US President Donald Trump’s first 100 days in office and amid his rising tariff threats, Taiwan Electrical and Electronic Manufacturers’ Association (TEEMA, 台灣電子電機公會) chairman Richard Lee (李詩欽) said yesterday. The association led a delegation of seven AI server manufacturers to Washington, as well as the US states of California, Texas and New Mexico, to discuss land and tax issues, as Taiwanese firms speed up their production plans in the US with many of them seeing Texas as their top option for investment, Lee said. The