World oil prices fell on Friday after three straight days of gains as government data showed the US economy shrank more sharply than expected in the fourth quarter of last year.

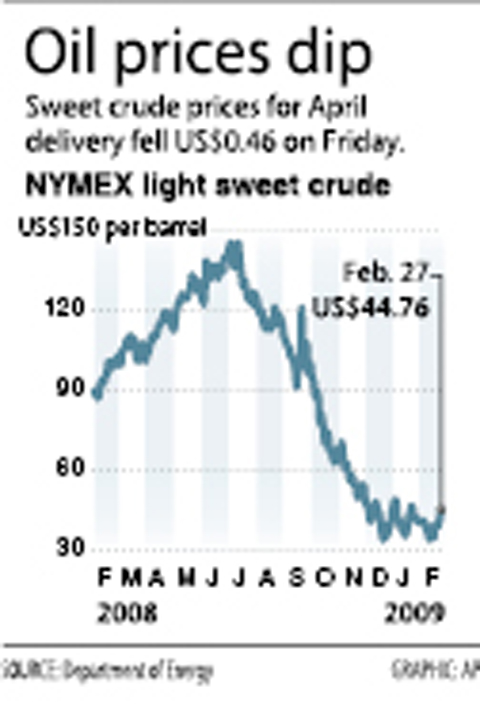

New York’s main contract, light sweet crude for April delivery, fell US$0.46 lower from Thursday’s close to end at US$44.76 a barrel.

In London, Brent North Sea crude for April shed US$0.16 to US$46.35 per barrel.

“The market reacted negatively to the GDP figure that came out this morning,” Andy Lipow at Lipow Oil Associates said.

The US economy contracted a stronger-than-expected 6.2 percent in the fourth quarter, the US Commerce Department said just before markets opened Friday, highlighting the meltdown in activity late last year in the world’s biggest oil consuming nation.

The figure was far worse than the negative 5.4 percent annual rate expected by most analysts and the sharpest contraction since the first quarter of 1982.

Oil prices recovered slightly from their lows in line with stocks in late trading, traders said.

“The crude market is wrestling with the fact they’re not sure whether OPEC cut enough production given the decline of demand that we’ve seen,” Lipow said.

Oil prices had surged in recent days in reaction to rising US gasoline stocks and clear indications of output cuts by OPEC.

OPEC announced late last year output cuts of 4.2 million barrels per day in a bid to reverse tumbling prices, and members looked to be sticking to the planned reductions.

“If current price levels do prove to be the base from which oil prices rise, it is going to be a long hard climb, at best,” John Kilduff of MF Global said. “Summer driving season may turn out to be a bust, if consumers choose to stay cautious this year.”

Crude oil prices covered a range between US$37.65 and Thursday’s high of US$45.30 this week, he said.

“The week’s high represented over a 9 percent improvement from last Friday’s settlement, against a very grim macroeconomic backdrop,” he said.

EARLY TALKS: Measures under consideration include convincing allies to match US curbs, further restricting exports of AI chips or GPUs, and blocking Chinese investments US President Donald Trump’s administration is sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new US president plans to expand efforts that began under former US president Joe Biden to limit Beijing’s technological prowess. Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd and ASML Holding NV engineers from maintaining semiconductor gear in China, people familiar with the matter said. The aim, which was also a priority for Biden, is to see key allies match China curbs the US

The popular Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) arbitrage trade might soon see a change in dynamics that could affect the trading of the US listing versus the local one. And for anyone who wants to monetize the elevated premium, Goldman Sachs Group Inc highlights potential trades. A note from the bank’s sales desk published on Friday said that demand for TSMC’s Taipei-traded stock could rise as Taiwan’s regulator is considering an amendment to local exchange-traded funds’ (ETFs) ownership. The changes, which could come in the first half of this year, could push up the current 30 percent single-stock weight limit

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

‘SACRED MOUNTAIN’: The chipmaker can form joint ventures abroad, except in China, but like other firms, it needs government approval for large investments Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) needs government permission for any overseas joint ventures (JVs), but there are no restrictions on making the most advanced chips overseas other than for China, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. US media have said that TSMC, the world’s largest contract chipmaker and a major supplier to companies such as Apple Inc and Nvidia Corp, has been in talks for a stake in Intel Corp. Neither company has confirmed the talks, but US President Donald Trump has accused Taiwan of taking away the US’ semiconductor business and said he wants the industry back