Asian stocks declined for the third consecutive week as the deepening global recession crimped earnings and forced companies to raise capital.

Nomura Holdings Inc, Japan’s largest brokerage, slumped 7.8 percent on concern its US$3.1 billion stock sale will dilute shareholder value. Woolworths Ltd, Australia’s biggest retailer, lost 5.4 percent on lower-than-expected profit. BlueScope Steel Ltd, the nation’s largest steelmaker, tumbled 29 percent after forecasting a second-half loss and slashing its dividend.

“Pessimism about company earnings hasn’t yet run its course,” said Naoyuki Torii, general manager of equities at Fukoku Mutual Life Insurance Co, which manages about US$59 billion. “As massive losses are eating into companies’ capital, investors are expecting more businesses will sell new shares and dilute shareholders’ equity.”

The MSCI Asia-Pacific Index lost 1.1 percent in the past five days to 75.19, extending losses after posting its steepest weekly plunge since October in the previous week. The gauge, which has lost 16 percent this year, fell to the lowest in more than five years on Feb. 24.

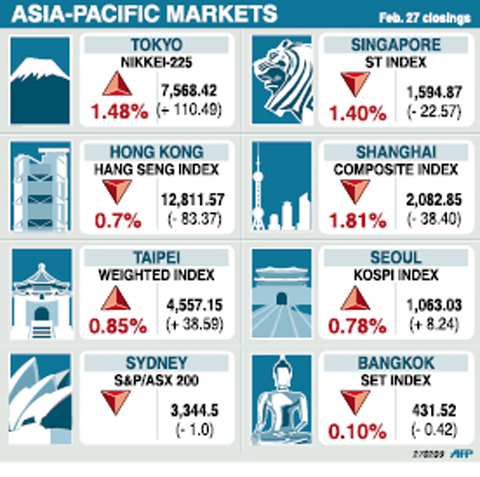

The Nikkei 225 Stock Average gained 2.1 percent this week, while Hong Kong’s Hang Seng index added 0.9 percent. China’s Shanghai Composite Index slumped 8.7 percent and Australia’s S&P/ASX 200 Index dropped 1.7 percent.

MSCI’s Asian index slumped by a record 43 percent last year as the credit crunch tipped the world’s largest economies into recession, forcing companies to cut jobs amid falling profits. Earnings estimates for companies in the gauge have been slashed 44 percent since the beginning of this year, data compiled by Bloomberg show.

Taiwanese share prices are expected to extend momentum next week, as the market is full of liquidity with bargain hunters eager to take advantage of low valuations, dealers said on Friday.

The market is expected to test 4,700 points next week, while the market is likely to see support at around 4,400 points as investors pocket profits, they said.

For the week ended Friday, the weighted index rose 120.21 points, or 2.71 percent, to 4,557.15 after a 3.35 percent fall the previous week.

Average daily turnover stood at NT$62.53 billion (US$1.79 billion), compared with NT$65.84 billion a week ago.

“After the central bank repeatedly cut its key interest rates, the market is immersed with idle money. Many investors are seeking buying opportunities,” Grand Cathay Securities (大華證券) analyst Mars Hsu said.

Last week, the central bank slashed rates for the seventh time in four months to boost the domestic economy, which contracted 8.36 percent in the fourth quarter of last year.

“Electronics stocks may have a better chance to gain as major companies have received large orders from China. It is an encouraging sign,” Hsu said.

In other markets on Friday it was:

KUALA LUMPUR: Down 0.3 percent. The Kuala Lumpur Composite Index lost 2.75 points to 890.67 as negative leads from Wall Street kept investors on the sidelines.

MANILA: Down 0.4 percent. The composite index fell 8.16 points to 1,872.22.

MUMBAI: Down 0.71 percent. The benchmark 30-share SENSEX index slid 63.25 points to 8,891.61, snapping two consecutive days of gains.

WELLINGTON: Up 0.99 percent. The benchmark NZX-50 index gained 24.88 points to 2,522.32.

PROTECTION: The investigation, which takes aim at exporters such as Canada, Germany and Brazil, came days after Trump unveiled tariff hikes on steel and aluminum products US President Donald Trump on Saturday ordered a probe into potential tariffs on lumber imports — a move threatening to stoke trade tensions — while also pushing for a domestic supply boost. Trump signed an executive order instructing US Secretary of Commerce Howard Lutnick to begin an investigation “to determine the effects on the national security of imports of timber, lumber and their derivative products.” The study might result in new tariffs being imposed, which would pile on top of existing levies. The investigation takes aim at exporters like Canada, Germany and Brazil, with White House officials earlier accusing these economies of

Teleperformance SE, the largest call-center operator in the world, is rolling out an artificial intelligence (AI) system that softens English-speaking Indian workers’ accents in real time in a move the company claims would make them more understandable. The technology, called accent translation, coupled with background noise cancelation, is being deployed in call centers in India, where workers provide customer support to some of Teleperformance’s international clients. The company provides outsourced customer support and content moderation to global companies including Apple Inc, ByteDance Ltd’s (字節跳動) TikTok and Samsung Electronics Co Ltd. “When you have an Indian agent on the line, sometimes it’s hard

‘SACRED MOUNTAIN’: The chipmaker can form joint ventures abroad, except in China, but like other firms, it needs government approval for large investments Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) needs government permission for any overseas joint ventures (JVs), but there are no restrictions on making the most advanced chips overseas other than for China, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. US media have said that TSMC, the world’s largest contract chipmaker and a major supplier to companies such as Apple Inc and Nvidia Corp, has been in talks for a stake in Intel Corp. Neither company has confirmed the talks, but US President Donald Trump has accused Taiwan of taking away the US’ semiconductor business and said he wants the industry back

PROBE CONTINUES: Those accused falsely represented that the chips would not be transferred to a person other than the authorized end users, court papers said Singapore charged three men with fraud in a case local media have linked to the movement of Nvidia’s advanced chips from the city-state to Chinese artificial intelligence (AI) firm DeepSeek (深度求索). The US is investigating if DeepSeek, the Chinese company whose AI model’s performance rocked the tech world in January, has been using US chips that are not allowed to be shipped to China, Reuters reported earlier. The Singapore case is part of a broader police investigation of 22 individuals and companies suspected of false representation, amid concerns that organized AI chip smuggling to China has been tracked out of nations such