Deep in the red for the first two months of this year, Wall Street enters March with frayed nerves in anticipation of more weak data as investors look for any signs of an end to the horrific economic slump.

With some indexes at 12-year lows, the market remains cautious about the economic outlook, despite reassuring comments in the past week from Federal Reserve chairman Ben Bernanke suggesting the worst crisis in decades could ease this year.

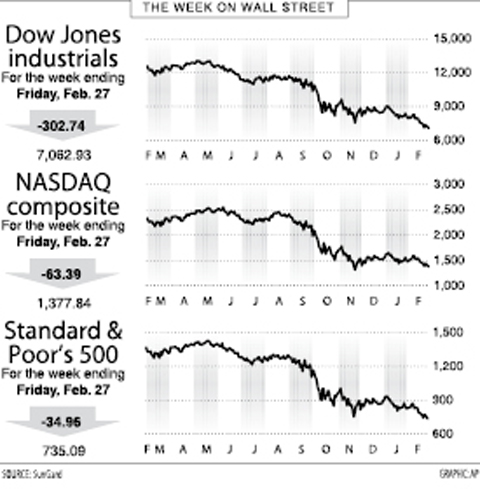

The Dow Jones Industrial Average of 20 blue-chips slid 4.1 percent to end Friday at 7,062.93, its lowest level since 1997.

The broad-market Standard & Poor’s 500 sank to its lowest close since December 1996, losing 4.5 percent to 735.09.

The technology-heavy NASDAQ composite fell 4.4 percent over the week to 1,377.84, near its lows from last November.

With a bear market in full force, the Dow has dropped 19.52 percent so far this year after a slide of more than 11 percent for last month. The S&P is off 18.62 percent in the year and the NASDAQ down 12.63 percent.

Al Goldman at Wachovia Securities acknowledged that he was wrong in suggesting the market had established a low point in November but still held out hope for a rebound soon.

“In hindsight, our timing may have been too optimistic; the bottoming out for the bear could start somewhat lower,” he said. “However, history shows that the economy and the stock market will recover.”

The market got a brief lift early in the week after Bernanke suggested the recession could end this year — but added that this was contingent on a series of rescues and stimulus efforts working as intended.

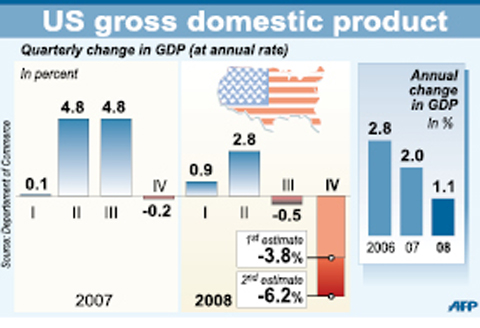

Investors had to cope with more grim economic news including a downward revision showing a stunning 6.2 percent annualized drop in fourth quarter economic activity, highlighting a deepening recession.

A government plan to boost its stake in troubled banking giant Citigroup to as much as 36 percent through a stock conversion also roiled the market and sparked further debate over whether the move was an effective nationalization.

Sal Guatieri at BMO Capital Markets said it was unclear whether this type of action, which could be extended to other banks, would revive them or simply keep them alive as “zombie” banks.

“An ongoing concern is that the toxic assets held by ‘zombie’ banks on government life-support could continue to bleed value from the illiquid assets held by still-healthy banks,” he said.

The coming week could bring more bad news, with last month’s auto sales expected to be weak and a payrolls survey expected to show further massive job losses — perhaps as many as 600,000, according to some analysts.

Yet some analysts say the stock market is “oversold,” having already discounted the worst economic scenario.

PROTECTION: The investigation, which takes aim at exporters such as Canada, Germany and Brazil, came days after Trump unveiled tariff hikes on steel and aluminum products US President Donald Trump on Saturday ordered a probe into potential tariffs on lumber imports — a move threatening to stoke trade tensions — while also pushing for a domestic supply boost. Trump signed an executive order instructing US Secretary of Commerce Howard Lutnick to begin an investigation “to determine the effects on the national security of imports of timber, lumber and their derivative products.” The study might result in new tariffs being imposed, which would pile on top of existing levies. The investigation takes aim at exporters like Canada, Germany and Brazil, with White House officials earlier accusing these economies of

Teleperformance SE, the largest call-center operator in the world, is rolling out an artificial intelligence (AI) system that softens English-speaking Indian workers’ accents in real time in a move the company claims would make them more understandable. The technology, called accent translation, coupled with background noise cancelation, is being deployed in call centers in India, where workers provide customer support to some of Teleperformance’s international clients. The company provides outsourced customer support and content moderation to global companies including Apple Inc, ByteDance Ltd’s (字節跳動) TikTok and Samsung Electronics Co Ltd. “When you have an Indian agent on the line, sometimes it’s hard

‘SACRED MOUNTAIN’: The chipmaker can form joint ventures abroad, except in China, but like other firms, it needs government approval for large investments Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) needs government permission for any overseas joint ventures (JVs), but there are no restrictions on making the most advanced chips overseas other than for China, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. US media have said that TSMC, the world’s largest contract chipmaker and a major supplier to companies such as Apple Inc and Nvidia Corp, has been in talks for a stake in Intel Corp. Neither company has confirmed the talks, but US President Donald Trump has accused Taiwan of taking away the US’ semiconductor business and said he wants the industry back

PROBE CONTINUES: Those accused falsely represented that the chips would not be transferred to a person other than the authorized end users, court papers said Singapore charged three men with fraud in a case local media have linked to the movement of Nvidia’s advanced chips from the city-state to Chinese artificial intelligence (AI) firm DeepSeek (深度求索). The US is investigating if DeepSeek, the Chinese company whose AI model’s performance rocked the tech world in January, has been using US chips that are not allowed to be shipped to China, Reuters reported earlier. The Singapore case is part of a broader police investigation of 22 individuals and companies suspected of false representation, amid concerns that organized AI chip smuggling to China has been tracked out of nations such