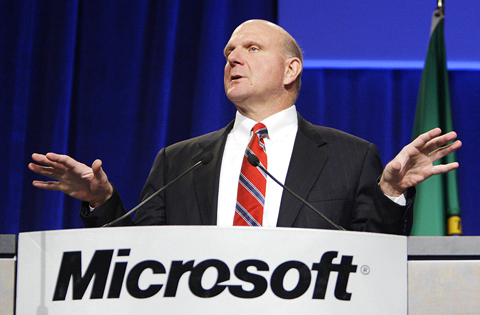

Not everyone is slashing jobs in these grim economic times. Microsoft Corp has no plans to cut back on research spending and plans to add workers in the coming year, senior executive Craig Mundie said on Friday.

“Right now we’re still on a plan to complete 100 percent of our college recruitment plan globally,” he told reporters.

“The ability to get top talent has actually improved” as the world enters what could be a punishing recession.

PHOTO: AP

Nor is Microsoft, which has 90,000 employees and more than US$20 billion in cash on hand, decreasing its global budget for educational programs — which affects 100 countries, said Mundie, the software giant’s chief research and strategy officer.

Mundie said in an interview during a 21-nation Pacific Rim economic summit that top management decided a few weeks ago it would slow hiring. But he said its US$8 billion research budget wouldn’t be trimmed.

“Our position at this point is that we hope to continue to actually still have some growth in our employment through the course of the year. But we’re monitoring the situation carefully,” he said.

Mundie said he believed Microsoft could actually benefit from the global downturn as people decide to hold meetings online rather than get on airplanes — or save on phone costs by relying more on voice-over-Internet technology.

“I think we might see some movement toward those things that have an almost immediate payback in terms of productivity or cost containment,” he said.

Separately, Yahoo has sold European comparison shopping service Kelkoo to a British investment firm, Kelkoo founder and former chief executive Pierre Chappaz said on Friday.

The sale comes as Yahoo searches for a new chief executive to replace Jerry Yang (楊致遠), the Yahoo co-founder who announced this week that he would be stepping down after less than 18 months.

Earlier this year, Yang rejected a US$47 billion takeover offer from software giant Microsoft, earning the ire of many shareholders.

Chappaz, in a posting on his blog, published a memo to Kelkoo employees from a Yahoo Europe executive, Glen Drury, announcing the sale of Kelkoo to British private equity firm Jamplant Ltd.

“Philip Smyth, chairman of Jamplant, believes that with our backing, Kelkoo should be able to accelerate its growth much faster as a standalone company,” the memo from Drury said.

Chappaz, who founded Kelkoo in 1999 but has since left, said Kelkoo was sold for under 100 million euros (US$125 million), significantly less than the 475 million Euros paid by Yahoo for the firm in 2004.

In his blog posting, Chappaz delivered a parting shot at Yahoo saying “the difference is the price of management incompetence that led Yahoo’s share price under nine dollars.”

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his