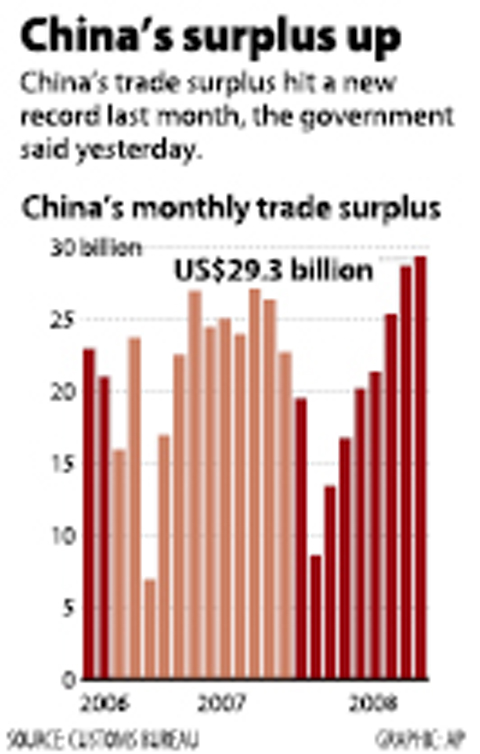

China’s trade surplus widened to a record last month as exports withstood the global economic slowdown and falling commodity prices reduced the import bill.

Exports rose 21.5 percent from a year earlier to US$136.4 billion after gaining 21.1 percent in August, the customs bureau said on its Web site. The trade surplus climbed to US$29.3 billion, a figure derived by deducting the value of imports from the number for exports.

China has stimulated the world’s fourth-biggest economy by cutting interest rates twice in a month to counter the financial crisis. The surplus swelled a record US$1.8 trillion in foreign-currency reserves, which may help the nation maintain growth of more than 9 percent as a global recession looms.

“It’s not a bad thing to have a relatively large trade surplus when there’s a global financial crisis,” said Wang Qian (王黔), an economist at J.P. Morgan in Hong Kong.

“China’s foreign-currency holdings will help the country to survive the crisis,” Wang said.

The median forecasts in a survey of 13 economists were for export growth of 20 percent and a trade surplus of US$24.5 billion. The previous record was US$28.7 billion in August.

Imports increased 21.3 percent to US$107.1 billion after climbing 23.1 percent in the previous month. Falling prices for commodities such as copper and oil have trimmed the value of inward shipments.

Export growth is down from 25.7 percent for all of last year.

“Although the numbers look like China’s exports are holding up, the volume growth of exports has slowed to below 10 percent,” Wang said.

“Export growth will continue to weaken as the economic slowdown spreads from developed economies to emerging markets,” Wang said.

Export growth to the US slowed by 4.6 percentage points from a year earlier to 11.2 percent in the first nine months, the customs bureau said.

Trade with India “surged,” it said, with imports and exports together jumping 54.9 percent in the first nine months from a year earlier.

“Maybe world demand is providing a last gasp,” said Ben Simpfendorfer, an economist with Royal Bank of Scotland Plc in Hong Kong.

“Look for a sharp slowdown in the fourth quarter. The final two months of the year will be particularly weak as electronics exports are typically shipped during this period and they are the export sector’s growth engine,” he said.

China’s latest cut in borrowing costs, which reduced the one-year lending rate to 6.93 percent, came last week as part of an emergency coordinated bid to thaw credit markets.

The US Federal Reserve, the European Central Bank and four other central banks also lowered borrowing costs.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

WARNING SHOT: The US president has threatened to impose 25 percent tariffs on all imported vehicles, and similar or higher duties on pharmaceuticals and semiconductors US President Donald Trump on Wednesday suggested that a trade deal with China was “possible” — a key target in the US leader’s tariffs policy. The US in 2020 had already agreed to “a great trade deal with China” and a new deal was “possible,” Trump said. Trump said he expected Chinese President Xi Jinping (習近平) to visit the US, without giving a timeline for his trip. Trump also said that he was talking to China about TikTok, as the US seeks to broker a sale of the popular app owned by Chinese firm ByteDance Ltd (字節跳動). Trump last week said that he had

STRUGGLING TO SURVIVE: The group is proposing a consortium of investors, with Tesla as the largest backer, and possibly a minority investment by Hon Hai Precision Nissan Motor Co shares jumped after the Financial Times reported that a high-level Japanese group has drawn up plans to seek investment from Elon Musk’s Tesla Inc to aid the struggling automaker. The group believes the electric vehicle (EV) maker is interested in acquiring Nissan’s plants in the US, the newspaper reported, citing people it did not identify. The proposal envisions a consortium of investors, with Tesla as the largest backer, but also includes the possibility of a minority investment by Hon Hai Precision Industry Co (鴻海精密) to prevent a full takeover by the Apple supplier, the report said. The group is