Hong Kong Disneyland will celebrate its birthday on Friday after three difficult years, as its new managing director juggles a grab for Chinese visitors with a battle over how to fund expansion.

The theme park has struggled to attract enough visitors since it opened to great fanfare in 2005, and has faced criticism it failed to understand both the local and Chinese markets.

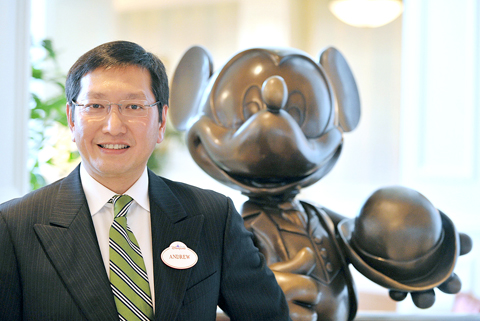

But a shift to more Chinese-friendly marketing earlier this year was reinforced by the appointment of managing director Andrew Kam (金民豪), whose career has been spent selling another US icon, Coca-Cola, to China.

PHOTO: AFP

“I have yet to go into the details of the plan we will set for next year, but it will be fairly aggressive in terms of [visitor] growth,” Kam told a small group of reporters last week just two days after starting his job.

“We are going to invest more resources in developing these markets ... China is probably the single largest market outside Hong Kong for us — we are looking for expansion there,” he said.

Kam said Disneyland would be employing more staff to market the park in China and build better relationships with travel agents. He is also hoping the Chinese and Hong Kong governments will agree a special visa scheme for visitors from Guangdong Province.

But cooperation with the local government, which owns 57 percent of the park, has been strained.

Legislators have criticized the US$3 billion park for being a bad deal for taxpayers who paid the vast majority of the start-up costs.

And they have balked at further investment when more pressing concerns, such as inflation, are vexing residents.

“Disney has a huge credibility gap ... They got too good an original deal,” said John Ap, a specialist on tourism at Hong Kong’s Polytechnic University.

Kam insists new attractions are necessary, but there is no sign 18 months of funding negotiations will end soon.

“[Both shareholders] have an interest in making this park work and expansion is part of the strategy,” he said.

The biggest question mark remains attendance figures.

The management has repeatedly refused to confirm figures despite the huge public investment, but a recent newspaper report said visitor numbers were expected to hit 5.6 million in the third year.

Taiwan would remain in the same international network for carrying out cross-border payments and would not be marginalized on the world stage, despite jostling among international powers, central bank Governor Yang Chin-long (楊金龍) said yesterday. Yang made the remarks during a speech at an annual event organized by Financial Information Service Co (財金資訊), which oversees Taiwan’s banking, payment and settlement systems. “The US dollar will remain the world’s major cross-border payment tool, given its high liquidity, legality and safe-haven status,” Yang said. Russia is pushing for a new cross-border payment system and highlighted the issue during a BRICS summit in October. The existing system

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is expected to grow its revenue by about 25 percent to a new record high next year, driven by robust demand for advanced technologies used in artificial intelligence (AI) applications and crypto mining, International Data Corp (IDC) said yesterday. That would see TSMC secure a 67 percent share of the world’s foundry market next year, from 64 percent this year, IDC senior semiconductor research manager Galen Zeng (曾冠瑋) predicted. In the broader foundry definition, TSMC would see its market share rise to 36 percent next year from 33 percent this year, he said. To address concerns

Intel Corp chief financial officer Dave Zinsner said that a formal separation of the company’s factory and product development divisions is an open question that would be decided by the chipmaker’s next leader. Zinsner, who is serving as interim co-CEO following this month’s ouster of Pat Gelsinger, made the remarks on Thursday at the Barclays technology conference in San Francisco alongside co-CEO Michelle Johnston Holthaus. Intel’s struggles to keep pace with rivals — along with its deteriorating financial condition — have spurred speculation that the next CEO would make dramatic changes. That has included talk of a split of the company’s manufacturing

PROTECTIONISM: The tariffs would go into effect on Jan. 1 and are meant to protect the US’ clean energy sector from unfair Chinese practices, the US trade chief said US President Joe Biden’s administration plans to raise tariffs on solar wafers, polysilicon and some tungsten products from China to protect US clean energy businesses. The notice from the Office of US Trade Representative (USTR) said tariffs on Chinese-made solar wafers and polysilicon would rise to 50 percent from 25 percent and duties on certain tungsten products would increase from zero to 25 percent, effective on Jan. 1, following a review of Chinese trade practices under Section 301 of the US Trade Act of 1974. The decision followed a public comment period after the USTR said in September that it was considering