Carrefour SA, the world's second-largest retailer, yesterday announced that it is taking over Tesco Stores (Taiwan) Co's six outlets and two development sites as part of an asset-swap deal with Tesco Plc in the UK valued at a total of 132 million euros (US$159 million).

In return, Carrefour will hand over its 11 outlets in the Czech Republic and 4 stores in Slovakia to the UK's biggest retailer at 189 million euros.

This is the first deal of its kind between two global retail groups. The swap reflects both companies' desire to focus on markets where they aim to become dominant players.

"It's hard to survive the fierce competition if you're not No. 1 or No. 2," Allan Tien (

"If you find yourself struggling hard to make headway in certain countries, why keep doing it? We're late in breaking into the Czech Republic and Slovakia, and Tesco faces the same situation in Taiwan. I think this new breakthrough will facilitate these two groups' healthy operations," he said.

The deal, which is currently pending approval by the nation's Fair Trade Commission, will boost Carrefour's market presence from 33 percent with 36 outlets nationwide to a promising 40 percent with 42 outlets, he said.

PHOTOS: YANG YA-MIN, TAIPEI TIMES

Tien promised that no job cuts will occur, as Carrefour Taiwan -- a joint venture between the company's Paris-based headquarters and Taiwan's Uni-President Enterprises Corp (統一企業) -- will accommodate all of its smaller rival's employees.

"As soon as the government approves the takeover, which might take around two months, we'll start replacing the store signs and product mix," which would mark the complete withdrawal of Tesco from the local market, he said.

Tesco chief financial officer Andrew Higginson said in an interview yesterday that the company's move into Taiwan was ill-timed, and its store openings were too slow.

The UK retailer entered the nation in 2000 with a relatively slow pace of store expansion compared with its stronger rivals, including Carrefour, which is still maintaining its policy of opening three to four stores in Taiwan every year.

"All the retailers have been spreading themselves too thinly abroad and now it's time for them to refocus on the areas where they're doing well," said Hilary Cook, director of investment strategy at Barclays Private Clients in London, which oversees the equivalent of about US$88 billion, including Tesco and Carrefour shares.

"Food retailing is all about economies of scale," he added.

Daisy Lee (

"Our operations and services will remain unchanged until the takeover procedure commences in several months. Consumers can still use their gift vouchers.

Carrefour, with about half of its 73 billion euros in annual sales coming from outside France, exited Mexico and Japan this year. Tesco, which is the biggest hypermarket operator in Slovakia, is bolstering its position in the country and neighboring Czech Republic.

Tesco's international sales climbed 17 percent at constant exchange rates in the 24 weeks ended Aug. 13. to ?4.2 billion pounds (US$7.4 billion). It makes about 30 percent of its sales overseas.

Higginson said Tesco had no plans to leave any other countries, nor for any other store-swap deals.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

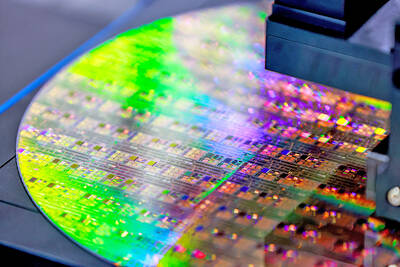

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September