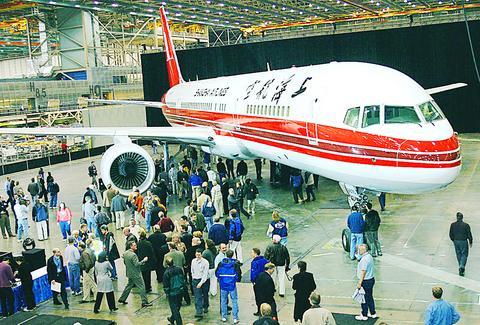

The Boeing Co has closed out the 757 commercial jet program with the last of the 1,050 jets to roll off the assembly line.

T-shirts showing a 757 with the words, "Celebrate the Legacy," were worn by thousands of past and present Boeing workers on Thursday at a ceremony marking the end of two decades of production of the 200-passenger plane in this Seattle suburb.

PHOTO: EPA

"A big chunk of my life has been spent on this program," said Clyde Brown, who worked on the 757 line from the start more than 22 years ago to the end. "That plane has been good to me."

The last 757 is scheduled for delivery to Shanghai Airlines in April.

Brown and many other workers will now work on another plane that figured in the demise of the 757 -- the newest models of the 737, also made in Renton. No layoffs from the end of 757 production are planned.

Alan Mulally, head of the company's commercial airplane division, said Boeing plans to "crank up" 737 production but gave no details.

Boeing, based in Chicago, announced in July that after cutting more than 27,000 jobs in three years, about 3,000 workers will be hired in the Puget Sound region by Dec. 31.

Many are in technical and engineering jobs for the 7E7 program in Everett and a military program to equip the 737 airframe as a Navy submarine-hunting aircraft.

Any new hires for 737 production were factored into Boeing's employment forecast in July, a spokeswoman said.

Mulally was an engineer on the original design team for the 757 program, which was headed by Philip Condit, who went on to become chief executive of Boeing but resigned earlier this year in an uproar over the use of dubious methods to win government contracts.

At the ceremony Mulally noted that all but 20 of the 757s remain in service worldwide.

"It has one of the great safety records of any plane in the world," he said.

One unique feature for Boeing was simultaneous design of the single-aisle 757 and the widebody 767, which is assembled in Everett.

Despite differences in size and range, they were designed with common flight decks so pilots trained on one could fly the other with little additional training, resulting in big cost savings for airlines.

Sales of 757s reached a peak of 99 planes in 1992 but declined to 45 by 2000, then plummeted in the airline industry slump that followed the terrorist attacks of Sept. 11, 2001.

Two of the three planes seized by the terrorists were 757s. One hit the Pentagon and the other crashed into a field in Pennsylvania after passengers stormed the cockpit.

Factors in the end of the line for the 757 include development of bigger, more economical and longer-range 737 models, the 7E7 Dreamliner that Boeing plans to begin building in 2006 and competition from Airbus SAS.

Still, Mulally said predicted that Boeing would be providing product support for the 757 for "the next 30 to 40 years."

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to