On a dusty lot in Baghdad's bustling Karadah district is a fleet of polished second-hand sedans and decade-old BMWs. This is car dealer Abdullah Radi's makeshift showroom, which he dismantles every day at sundown to escape gangs of looters. He stows the cars in a faraway garage.

With customs duties now eliminated in Iraq, Radi ships the autos he sells from Dubai to the southern port of Basra and trucks them in. He sells as many as seven a week and says profits, which he won't disclose, are up 50 percent. Customers include government employees who are now being paid in dollars. Business is good enough that his five sons also sell used cars.

"With no tax and no customs, things are good, very good," says the 58-year-old father of 11, as he stands by the road in a flowing robe and headdress, clutching a satellite phone. The only drawbacks: looters, he says.

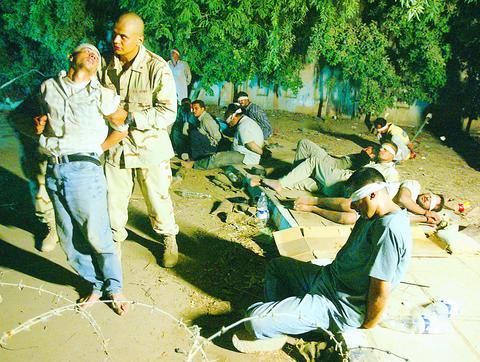

PHOTO: REUTERS

Last month's decision by the US-led Coalition Provisional Authority to eliminate all import duties until the end of the year to boost trade is spawning a new breed of Iraqi traders importing cars, electric fuses, nightgowns and fridges from Turkey, Syria, Jordan, the Gulf states and Egypt.

Paul Bremer, Iraq's chief US administrator, says it's only a matter of time before a free market takes hold.

"I am optimistic that the coalition will succeed in transforming the Iraqi economy from a closed, dead-end system to an open, vibrant place to do business," he told participants at the World Economic Forum at the Dead Sea near Amman, Jordan on June 22.

With the red tape gone, Iraqis are swarming the Baghdad Chamber of Commerce, where they register and pay as much as US$8 for a cross-border import license to show at foreign border posts.

The Chamber building is open for business -- even though looters stole the furniture and computers, slashed the door frames, ripped out the toilets and wrecked the fountains.

In the lobby, behind a few salvaged desks, officials hand out some 400 licenses a day to applicants, 50 percent more than in prewar days, according to general manager Abdulmalik Hussein. The US decision to lift customs tariffs is "the principal reason" behind the flurry, he says.

"Before, it wasn't easy to trade," adds trademark manager Sohad Ahmad, her head covered in a multicolored shawl, as she scrawls her signature across dozens of licenses brought to her by underlings. "This is a golden opportunity for merchants."

Standing with his license in hand is 39-year-old Adnan Al-Khozai, who has just separated from his trading partner and set himself up as an independent importer of car parts and clothing.

Adnan flashes a thumbs-up sign when asked about business.

"If there is safety and no taxes, then business is good," he says.

Safety is, however, lacking. At dawn the day before, near the Jordanian border, a hooded gang in a Nissan pickup truck sidled up to Al-Khozai's car, which carried US$60,000 worth of spare parts and women's clothing. They brandished Kalashnikovs, a Russian-made assault rifle.

While he managed to speed away, a convoy of trucks carrying 22 cars behind him was overtaken and the driver has since gone missing. Al-Khozai says he keeps a Kalashnikov and one other gun at home to protect his wife and three children.

In fact, Kalashnikovs are a common sight in Baghdad. One vendor's weapon leans behind two large boxes of air-conditioning units he is selling on the sidewalk.

In the nearby "Manama" appliance store opened last month, owner Nabil Abu Rivan keeps his Kalashnikov stowed away behind a large fan, and reachable from his desk. He keeps another seven weapons in the shop, nervously interrupting conversations to oversee staff unpacking boxes. A day earlier, his store was attacked by robbers who ran off empty-handed after Abu Rivan shot at them.

Partially stocked with refrigerators, television sets, and electric ovens, the store did brisk business when it first opened, selling 300 satellite phones a week, 500 TV sets, and 200 refrigerators. The buyers? "Ali Baba," says Abu Rivan with a smile, referring to wartime looters who were spending their newly found cash.

While few import barriers mean "we sell and we put the money in our pocket," says Abu Rivan, "I'd prefer laws. At the moment, anybody can sell, import or buy."

Competition has led him to lower the price of a 20cm Samsung TV to US$180 from US$260 initially.

Lawlessness also hits traders at home. Sherko Abdelrahman, a 32-year-old importer of electrical parts, woke up one night to find his wife in tears as vandals threw stones at his door. No harm was done, but Abdelrahman keeps a gun at home.

Power shortages compound the trouble. While Abdelrahman has sold 350 generators in just 20 days because of the heat -- 45 degrees Celsius at midday, on average -- and boosted their price to US$130 from US$85 amid growing demand, he says he longs for the day when he can go back to selling large electric circuits to factories.

"God willing, electricity will come," Abdelrahman says as he stuffs licenses for the Syrian and Lebanese borders in his pocket.

Some wonder how long it will be before the US administration reimposes tariffs. Iraq's economic welfare will depend on it, they say. US officials say they will hand economic decision-making over to the new Iraqi governing council to be appointed in mid-July and it will decide future trade regulation.

"We know nothing about the future," says the Chamber of Commerce's Hussein. "What kind of rules will we have? What's the next step? They won't leave things as they are."

To interim Central Bank Governor Faleh Daoud Salman, getting the import business going is "not the aim of the Iraqi economy."

"Some people want to make a quick profit," he said in an interview. "We must give priority to what the economy needs: foodstuffs, raw materials and new machines to rehabilitate industry, and utilities and services to all citizens. For 13 years we were under a blockade and sanctions. Trade, agriculture and industry have deteriorated."

MULTIFACETED: A task force has analyzed possible scenarios and created responses to assist domestic industries in dealing with US tariffs, the economics minister said The Executive Yuan is tomorrow to announce countermeasures to US President Donald Trump’s planned reciprocal tariffs, although the details of the plan would not be made public until Monday next week, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. The Cabinet established an economic and trade task force in November last year to deal with US trade and tariff related issues, Kuo told reporters outside the legislature in Taipei. The task force has been analyzing and evaluating all kinds of scenarios to identify suitable responses and determine how best to assist domestic industries in managing the effects of Trump’s tariffs, he

TIGHT-LIPPED: UMC said it had no merger plans at the moment, after Nikkei Asia reported that the firm and GlobalFoundries were considering restarting merger talks United Microelectronics Corp (UMC, 聯電), the world’s No. 4 contract chipmaker, yesterday launched a new US$5 billion 12-inch chip factory in Singapore as part of its latest effort to diversify its manufacturing footprint amid growing geopolitical risks. The new factory, adjacent to UMC’s existing Singapore fab in the Pasir Res Wafer Fab Park, is scheduled to enter volume production next year, utilizing mature 22-nanometer and 28-nanometer process technologies, UMC said in a statement. The company plans to invest US$5 billion during the first phase of the new fab, which would have an installed capacity of 30,000 12-inch wafers per month, it said. The

Taiwan’s official purchasing managers’ index (PMI) last month rose 0.2 percentage points to 54.2, in a second consecutive month of expansion, thanks to front-loading demand intended to avoid potential US tariff hikes, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday. While short-term demand appeared robust, uncertainties rose due to US President Donald Trump’s unpredictable trade policy, CIER president Lien Hsien-ming (連賢明) told a news conference in Taipei. Taiwan’s economy this year would be characterized by high-level fluctuations and the volatility would be wilder than most expect, Lien said Demand for electronics, particularly semiconductors, continues to benefit from US technology giants’ effort

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his